Matthew’s background as a quota compiler

My name is Matthew Trenhaile and I worked as an odds compiler in the UK Sport Spread Betting division of IG Index for six years. Steve has kindly allowed me to use his blog to showcase some of my writing and I hope to do so in a series of articles from the perspective of someone who has worked in the betting industry.

First I want to repeat some of the terms I will be using in my articles as the names of various things change from country to country and from time to time. When referring to a favourite, I use the words “Jolly” and “Rag” for underdog, which I think are very British terms. To describe smart bettors I use “Sharp” and “Square” for losing bettors.

These are very Vegas words and are also used to describe bookies which I can sometimes abbreviate as “books”. For alternative name accounts used to place bets I like the term bowler more, I think it’s an Australian term and I quite like it. When I describe odds I will use decimal odds and when I talk about money it will be in British pounds and pence just for my own convenience.

I’m seeing more and more industry insider articles, let alone TV documentaries, and they all seem to be sparking a lot of heated debate. I’m all for it if it puts you in a good mood, but remember that this is just my opinion and I’m happy to respect others’.

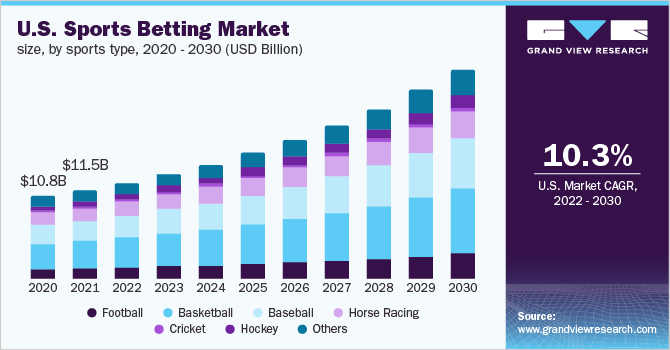

A developing betting industry

In each of the following articles, I aim to address issues from past, present, and future perspectives. I’ll start by reviewing odds composition and how it has evolved over the past fifteen years. I’ll also address the issue of bookmakers copying prices from one another, which seems to be a hot topic.

My perspective on odds creation comes from spread betting, which has been responsible for every significant shift in odds design over the last 25 years. For those unfamiliar with spread betting, visit the Sporting Index website to get an idea of what it entails.

The sports betting industry is still at the forefront of technological advances, with staff who went on to design other bookmakers’ models and companies like Sporting Solutions, a spin-off of Sporting Index, selling progressive prizes to other bookmakers. Many fixed odds bettors look to spread betting providers’ prices as a secondary check before placing their bets.

This is how odds compilation works

The creation of odds has gradually become more and more a question of databases, statistics and mathematical models and less and less a question of personal experience, intuition and feeling.

I’ve been fortunate to work with men who had watched thousands of hours of racing and could discern the finer nuances of how a horse was ridden, or the strategy of a particular trainer, but I’ve also been fortunate to work with people who are in the Were able to break down sports into their basic inputs and convert those inputs into probabilities before and during events.

Odds compilers were initially divided about Betfair’s prospects and certainly its use when it comes to compiling prices. I started working at a time when Betfair had just reached a significant level of liquidity and could not be ignored, if only because of the ever increasing number of arbitrage bettors. In 6 years we have used our Betfair API to evaluate all our horse racing products with a human just to oversee the process.

Compare that to when I started, when we had a dealer for every horseracing meeting and a room with 40 dealers at a time, when the number of closed sporting events was less than a tenth of what it is today. The luxury of being a subsidiary of a large financial company was that we were paid more than the rest of the industry and had more resources at our disposal, be it human resources or IT support.

All resources were increasingly devoted to sharing running events and developing increasingly complex models to generate running odds. These odds were generated for our customers, but also so that we could provide liquidity to the betting exchanges, allowing us to generate a significant stream of secondary income.

Creation of statistical models for sport

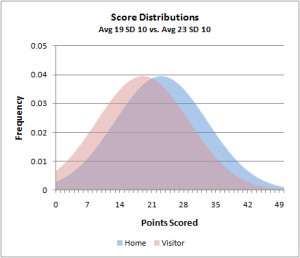

Most compiled statistical odds come from a simple count of how many times an event has occurred. Two football teams count how many times the home team has won at home in the last 20 games, how many times the away team has lost in the last 20 games, etc.

Of course, that was long before my time and what gave the bookies an advantage back then was that Studying the sports more than studying the players and knowing about comparative odds.

What I mean by that is that if a bookmaker has calculated that a team should win 50% of their home football games and the last time these two teams played you placed odds of 1.83 and the bettors paid attention like crazy then the bookmaker saves or remembers it and bets at 1.75 next time and when the bettors return and the bookmaker has pulled some extra value out of their margin simply because they know what the bettors did and what they were previously willing to pay.

Compiling the odds was more about knowing the bettors and their habits than the actual percentage probability of the outcome. Even today, this particular area makes the difference between bookmaking and punting. Bookmakers need to anticipate cash flows while the bettor needs to determine the likelihood of outcomes and find value.

In an online world, odds increasingly reflect actual odds and less and less reflect public opinion or the narrative of the event. The advent of running bets has really brought the compilation of odds to mathematical models. It was becoming too difficult for one human to quote prices in multiple markets for multiple ongoing events, all with a pen and some paper. Bookmakers needed automation, which meant templates.

How the bookmaker’s business models and views on internal odds composition have changed

You may think that odds are a bookmaker’s primary product and that developing them over the long term is the best strategy. However, this is a false assumption in modern bookmaking. Deciding which hotel to stay in based on the price of a beer in the minibar is not practical, and the bookies believe that the odds are about as important as that beer’s price.

Their product is entertainment, not the sale of an intellectual competition between the bettor and bookmaker. It is foolish to assume that this has always been the product sold by bookmakers. They sell an adrenaline rush, and anyone who thinks big characters go up against bettors and everyone in the horse betting rings is still living in the past.

The people I speak to recall the UK betting tax, huge profit margins, limited choices between bookmakers, non-payment, and threats of violence if they demand payment. I have no idea where the image of the gentleman bookie came from. Over time, some bookies will take your bets, and some won’t. Some will allow you to place large bets, and some won’t, and some will go bankrupt, while others won’t. This applies to both sharp and square bettors.

All bookmakers expect to win almost regardless of the quality of their odds (which is not necessarily the view of their compilers) and concentrate on getting players through rather than reducing the minibar’s beer price. Although I don’t approve of this model, I don’t see it disappearing anytime soon.

There can only be one Pinnacle

Now we come to the obligatory Pinnacle paragraph. Why can’t all bookmakers be like Pinnacle? The answer is simple: there can only ever be one Pinnacle business model. Others may make tweaks here and there, but the exact Pinnacle model cannot simply be copied.

Pinnacle’s slogan is that they welcome winners and that’s simply because they aim to beat every other sportsbook with the world’s largest exclusive sports trading team. By using the best odds compilers, offering low margins, accepting all arbitrage and savvy bettors, and adjusting their odds according to their level of accuracy, their odds become the most accurate representation of the likelihood of outcomes. They start the limits low at their most vulnerable limit and increase them as the price improves.

They don’t spend anything on marketing, but they allow absolutely anyone to use affiliate banners and spread their API to anyone they can, especially arbitrage and odds comparison services. Their low margins mean they are on the other side of arbitrage trades all day and night, and the square pound their price is against is so bad for pricing that they are looking at the value side of the trades must receive. In fact, they keep getting it, but they keep moving their price to capture that little bit of value every time. They become the biggest bettor at Bet365, Ladbrokes, William Hill etc., all without opening a single account.

Their risk management must be largely automated, and they must have the servers of an investment bank. Anyone else trying to implement this model and succeed will have to do so with smaller margins and better risk management, not to mention lots of capital. The only one I see really trying is Marathon, and they are not at the point of not closing accounts yet, far from it in fact.

What about all the Asian bookmakers accepting winners? Well, they like to take them on events where they see a huge amount of square money, which of course are all football games, some American sports, and maybe some decent tennis matches.

The Asian Handicap pattern is designed to offer low margins, fast movement, and high volume, and the sharpness of the money once it approaches the stop is almost irrelevant in some cases. Initially, the limits are low as with Pinnacle while the market makes the risk low.

However, they don’t use a Pinnacle model; they just have a large enough square volume to encompass certain aspects of it and are more comfortable having losing areas as long as the book as a whole is profitable

The Future of Odds Compilation

So where do I see the future of review compilation? Eventually I think odds collation will become a fully outsourced function for bookmakers (are they still bookmakers if they don’t do the book?). There will be specialized companies whose main function is to offer odds both before the game and during the race.

There are already several companies doing this, and companies have long made it their mission to provide liquidity to betting exchanges. You will see even more consistent prices than now. The reason you see so many “duplicates” of prices is because there is now such liquidity in some sports betting markets that there is now a market price similar to financial markets. In top-flight football, there is little incentive for bookmakers to deviate greatly from each other.

Believe me when I say extensive studies have been done showing that trading against the liquid sports market is loss making in the long run as a bookmaker, not necessarily as a bettor but when you have thousands of prizes to offer across so many events. You are best served by following the market.

There are more and more companies looking at the market and saying that a combined price of Pinnacle, IBC, SBO, Betfair (when liquid) and Bet365, for example football, can easily be cobbled together from the API and be more than strong enough will . These trades go nowhere and see an amazing amount of bets, keeping the prices true.

So why are they constantly creating arbitrage opportunities, even in liquid markets, I hear you cry. The answer is that we are still in a transitional phase in the industry and some still accept the idea of a market price that should simply move by the weight of money and not a trader’s opinion.

I actually envision increasing bookmaker confidence in these consolidated streams. They eliminate arbitrage, or at least at all pointy sources, and they are inexpensive to operate. I think they will also outsource all risk management.

There will always be exotic markets linked to the liquid core markets and if the bookies are sensible they will increase the limits on the core and lower the limits on the exotic stuff to £100 take-home, which is the average fun bettor is equivalent to ‘. As for horse racing, I have no idea where it will end up, just SP maybe? I actually think very low margin pari-mutuel betting would be the way to go, sort of universal Betfair SP. In Asia, this type of group betting has not deterred either recreational or professional bettors.

The problem with the UK is how many horrible races are going on but who knows if every bookie would pool the tickets and betfair and the tote and split the winnings then maybe something worthwhile could emerge and that would also pay for some of the rancid SP rig , this goes on. The rind will be beating the market as a whole and not weeding out the sick and low prices of bad books.

To do this, bettors and tipsters need to understand the strengths and weaknesses of the markets they bet on as well as the sports themselves. In the end, don’t worry about how the price is set or if all bookmakers are showing the same price, do just worry about hitting him because there will always be flaws and edges, even if they are smaller and harder to spot.

Why is the Bookmaker Rating Important for Bettors?

When it comes to sports betting, choosing the right bookmaker can be just as important as picking the right team to bet on. With so many options available, it can be overwhelming to decide which bookmaker to trust with your money. This is where bookmaker ratings come in.

Bookmaker ratings provide bettors with valuable information about different bookmakers, including their reputation, reliability, and customer service. By looking at ratings from trusted sources, such as industry experts or other bettors, you can get a sense of which bookmakers are trustworthy and which ones to avoid.

One of the most important factors to consider when choosing a bookmaker is their payout history. Bettors want to know that they will be paid out their winnings in a timely and reliable manner. Bookmaker ratings often include information about a bookmaker’s payout history, allowing you to make an informed decision about where to place your bets.

Another important factor to consider is the quality of the odds offered by a bookmaker. A bookmaker with consistently favorable odds can provide a significant advantage to bettors in the long run. Bookmaker ratings often include information about the competitiveness of a bookmaker’s odds, helping bettors find the best value for their money.

In addition to payout history and odds, bookmaker ratings can also provide information about the overall user experience, including website design, customer service, and mobile compatibility. By taking these factors into account, bettors can find a bookmaker that offers the best combination of value, reliability, and convenience.

Overall, bookmaker ratings are an essential tool for any serious bettor. By doing your research and choosing a reputable bookmaker, you can increase your chances of success and ensure a positive betting experience.